You can add Signature Bank to the list of failed banks. Sounds like they were primarily in the Crypto world.

FDIC insurance is great…as long as it lasts and you have less than $250k in said bank. Credit Unions have basically the same program thru the NCUA, and it covers $250k per depositor per CU as well.

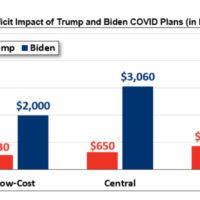

Agreed BMan! And many of us were shouting this out the whole time. And FWIW both Trump and Biden printed trillions, so maybe we can keep this apolitical (Reading your addition/pics now, HA nevermind!).

As usual, BigWerm speaking the truth on more ways than one!

As long as you have under $250k in your bank account, you are 100% safe. It’s when people start to freak out and think the money in their bank account isn’t safe, and then flock to the bank and withdraw all their money is when sh*t hits the fan. Bank runs are what will sink the ship.

B-man – Trump had out of control spending too. The deficit growth under Trump was the 3rd largest increase, relative to the size of the economy, of any presidential administration ever. And when you factor in the fact his term was only 4 years whereas most others were 8, it’s significant. Remember when he promised to eliminate the US national debt? Well he actually increased it by roughly 35%.

There’s no one party to blame for the situation we are in… Plenty of blame to go around.