[/quote]

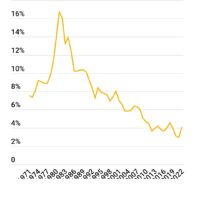

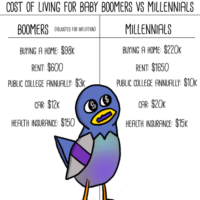

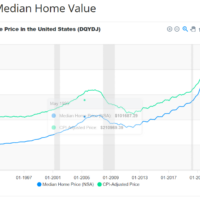

I see both sides of this. Things cannot be compared with validity across generations. Boomers could buy homes for 70-90K and nice vehicles for 10k. College was cheaper, and health insurance was substantially cheaper. Fast forward to today and people starting life on their own are facing exponentially more expensive everything.

For the flip side, ask you mom what she made per hour in 1991. A “good” job might have been 12-15$ an hour (just an off the cuff guess). Last week I just wrote a letter of recommendation for a 17 year old Junior in High School to do his summer work with an underground construction company (boring, splicing fiber, etc). He had the entire job description with him and showed me. $25.40 an hour with no experience necessary. To repeat, this kid is in high school and NOT living anywhere near the metro either. If I made $25 an hour at age 17 without any bills to pay…I’d probably have ended up in jail with my teenage decision making.

There are opportunities for every generation as well as hardships and tough situations. The beauty is that nothing stays the same for long.

[/quote]

True. My parents just divorced and their company went bankrupt as did they (filed bankruptcy). My mom took a job working overnights in a mailroom for moneygram (entry level position). She just had a high-school diploma and only work experience was as a bank teller so she didn’t make much money.

I dont have facts about today’s world vs 1991 but I gotta think that if this situation played out today, as opposed to 1991, what my mom was able to do with her circumstances wouldn’t be possible.

But yeah I agree comparisons across generations are not easy comparisons to make and its never apples to apples